The Cure for

Chargebacks

With ChargebackHelp, you get all of the world’s leading dispute deflection, chargeback alert, and representment tools in one place – from the industry’s leading experts.

Alleviate your chargeback headaches for good.

Pick and choose the tools that best suit your unique business needs by working hand in hand with our friendly professionals.

Leverage our intuitive and highly integrated technologies to automate processes and streamline workloads and start to put your chargeback headaches behind today.

“Since implementing ChargebackHelp, we’ve increased recovery rates by 28%, prevented over $500K in chargebacks, and reduced manual workload by 45% — all without disrupting our operations.”

Director of Risk, Top U.S. eCommerce Subscription Brand

Alleviate your chargeback headaches for good.

Pick and choose the tools that best suit your unique business needs by working hand in hand with our friendly professionals.

Leverage our intuitive and highly integrated technologies to automate processes and streamline workloads and start to put your chargeback headaches behind today.

“Since implementing ChargebackHelp, we’ve increased recovery rates by 28%, prevented over $500K in chargebacks, and reduced manual workload by 45% — all without disrupting our operations.”

Director of Risk, Top U.S. eCommerce Subscription Brand

Benefits of Partnering with ChargebackHelp

Prevent Chargebacks

Processing Protection

Greater Operational Efficiency

Reduce Cost

Lower Stress, More Sleep

Increased Customer Satisfaction

Stay Compliant with Evolving Regulations

Mitigate Fraud Losses

Improve Transaction Acceptance

Improve Chargeback Win Rates

Recover Lost Revenue

Streamline Tools to 1 Platform

Benefits of Partnering with ChargebackHelp

Prevent Chargebacks

Processing Protection

Greater Operational Efficiency

Reduce Cost

Lower Stress, More Sleep

Increased Customer Satisfaction

Stay Compliant with Evolving Regulations

Mitigate Fraud Losses

Improve Transaction Acceptance

Improve Chargeback Win Rates

Recover Lost Revenue

Streamline Tools to 1 Platform

About Us

The World’s Leading Experts in Chargeback Prevention

At ChargebackHelp we live and breathe chargebacks – it’s all we do! For more than a decade we’ve been trailblazers in providing end-to-end chargeback management solutions for thousands of merchants across multiple industries.

We’ve heard countless times from merchants how complicated it can be to launch, manage and navigate multiple tools from different providers. So, we’ve unified everything under one-roof and made it easy with the industry’s leading integration and automation technologies.

But technology is just part of the equation.

We provide you with the training to master our tools and offer ongoing support as partners in your success.

While other companies leave you to your own devices, we pride ourselves on a more

human-centric approach that ensures better results, and less stress.

End-to-end Chargeback Solutions

Our platform provides merchants worldwide with comprehensive solutions for transaction disputes, fraud, and chargebacks. We handle the complex integrations, ongoing maintenance, and compliance required to prevent chargebacks and recover lost revenue. You gain direct access to card networks, industry expertise, and automated dispute workflows — all in one solution.

End-to-end Chargeback Solutions

Our platform provides merchants worldwide with comprehensive solutions for transaction disputes, fraud, and chargebacks. We handle the complex integrations, ongoing maintenance, and compliance required to prevent chargebacks and recover lost revenue. You gain direct access to card networks, industry expertise, and automated dispute workflows — all in one solution.

Mobilize your transaction data in real time

Send that data on-demand to issuer & cardholder inquiries

Inform transaction confusion & disrupt first-party fraud

Stop disputes before they start

Reduce risk exposure by eliminating fraud & chargebacks

Automate your dispute resolutions

Deploy multiple solutions through a single integration

Lower fraud & chargeback ratios = increased auth rates

Recover your revenue from unwarranted chargebacks

Improve the representment workflow for optimum win rates

Automated compelling evidence in real time, on demand

Full data access & reporting for full accountability

No Nonsense Onboarding

We get you up-and-running fast with quick integration so you can start slashing those pesky chargebacks. Our platform adapts to your tech stack, not the other way around.

No hidden fees

No long term contract

No IT required

No barriers to entry

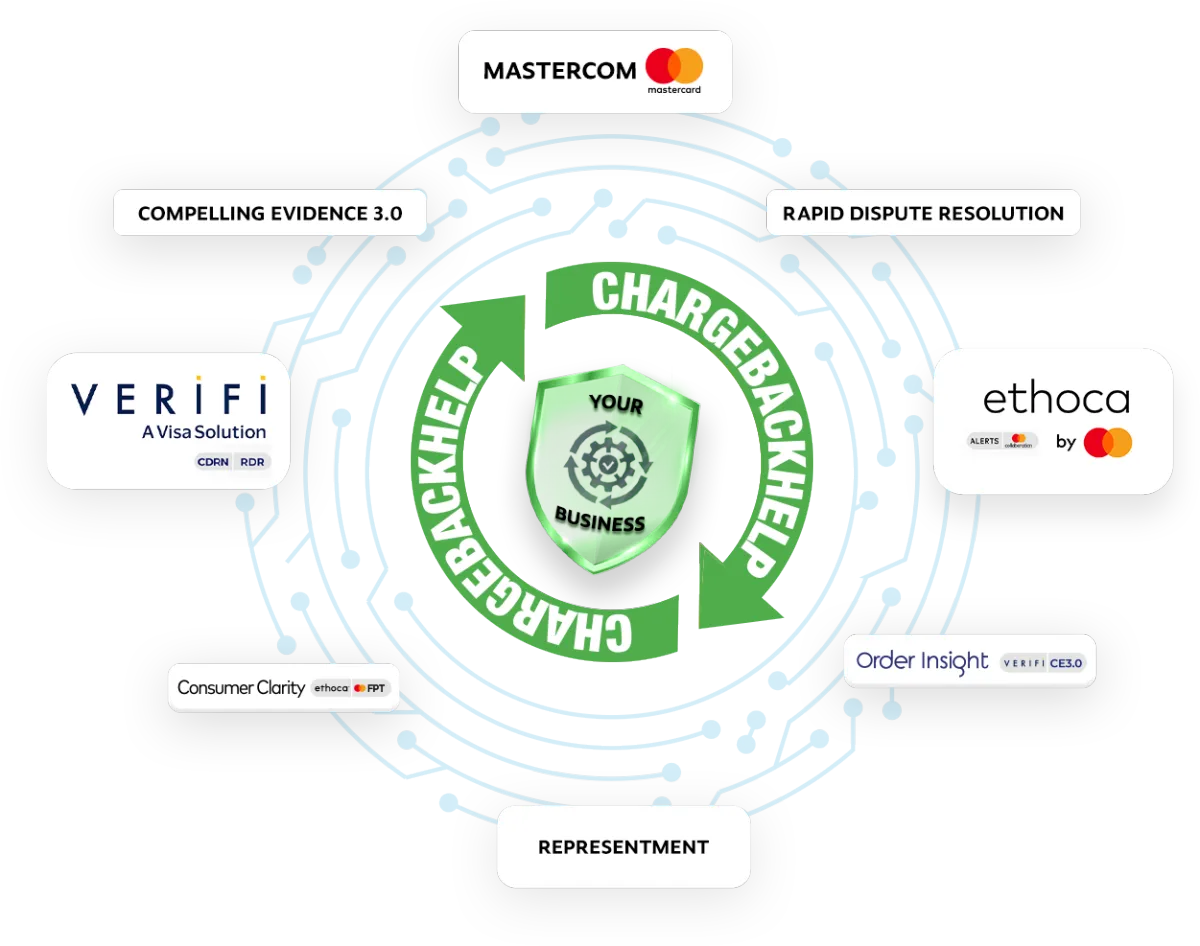

One-Stop Powerful Portal

ChargebackHelp is the unified chargeback operations platform built for professionals like you. We integrate tools from Visa, Mastercard, Verifi, and Ethoca into a single platform.

One login, one workflow – every dispute, every alert, fully centralized.

Connects all sources

Verifi CDRN, Compelling Evidence 3.0, Order Insight, Rapid Dispute Resolution (RDR), Ethoca Alerts, Mastercom Collaboration, Consumer Clarity, Representment

Tracks every dispute in real time across issuers, schemes, and alert types

Automates evidence preparation with templates optimized per brand

Exports case performance for audits, board reviews, and SLA monitoring

Save Precious Time

Spend more time growing the business and focusing on selling, less time worrying about chargebacks. Let our platform handle the mind-numbing legwork.

Say Goodbye to:

Toggling between portals for different issuers and tools.

Manual uploading and downloading of reports.

Maintaining spreadsheets for tracking.

Customizing evidence per card brand.

Become a KPI Champ

We speak your language:

Efficiency, compliance, throughput, and ultimately – money saved.

The results will speak for themselves on your P&L.

Time to Resolution

Reduce lag with automated alerts, task routing, and real-time statuses

SLA Adherence

Pre-built timelines and issuer-aligned logic ensure you stay within windows

Audit-Ready Transparency

All data exportable, filterable, and aligned to regulatory and leadership reporting

Win Rate Optimization

Evidence builders and workflows align with issuer behavior and brand-specific rules

Futureproof Your Operations

Fraudsters will find new strategies to swindle.

The card brands will continue to modify the regulations.

Regulations will tighten.

But don’t worry… we have you covered.

ChargebackHelp evolves with every industry change – so you’re always ahead, never scrambling to catch up.

But Don’t Just Take Our Word

See how leading risk teams are consolidating chargeback workflows and improving performance with less manual effort.

Request a tailored platform walkthrough based on your dispute volumes and current tools (no obligation)

Get a free operational audit to benchmark your current performance

Preview real dashboards, recovery metrics, and report templates

Frequently Asked Questions

Do you have an API?

Our API can either push data from or to you. It routes alerts to you while enabling you to respond to those alerts. What data you “push” or “pull” is customized to your processing needs. This is what we mean by “custom programming.” Our programmers can write this free of charge based upon volume and scope of work.

Does your coverage include card issuing banks overseas?

Yes. We’re happy to work with a wide variety of issuers, foreign and domestic. And to better serve our clients dealing with overseas banks, we have added a European office to cover concerns in both Europe and Asia.

How much are chargeback fees?

Chargeback fees typically range from $20 to $100 per dispute, depending on the acquiring bank and card network. These fees cover the cost of processing the chargeback and are charged regardless of the outcome. High chargeback volumes can lead to additional penalties and increased fees.

How to prevent fraudulent chargebacks?

Preventing fraudulent chargebacks involves using fraud detection tools, implementing 3-D Secure authentication, and monitoring transaction patterns. Clear billing descriptors, detailed transaction records, and proactive customer communication can also help reduce disputes.

What is a good chargeback rate?

A good chargeback rate is typically below 1% of total transactions. High chargeback rates can lead to penalties, increased fees, and account termination. Merchants should aim to maintain a low chargeback ratio by implementing fraud prevention measures and resolving disputes proactively.

Are refunds better than chargebacks?

Yes, refunds are generally better than chargebacks because they are less costly and do not incur additional fees or penalties. Refunds also help maintain positive customer relationships, whereas chargebacks can damage a merchant’s reputation and lead to account termination.

ChargebackHelp provides merchants with full-spectrum coverage against transaction disputes.